Why is your score important?

Your credit score is at the heart of a lender’s decision-making process when it comes to granting or denying you access to credit or loans. It allows them to judge your ability to repay your loan or keep up regular payments. So, as a starting point, lenders will investigate your credit report and use it to make a simple ‘yes’ or ‘no’ decision on whether to agree to lend you money or extend credit.

Moreover, if that decision is not a straight-forward yes or no, which is often the case with personal and other loans, your credit score and report will impact the TERMS you are offered on a loan or the credit limit on a credit card. For example, if your score is GOOD or better, the total amount offered and total time to pay the loan back will be higher and shorter than if your credit score of FAIR or below.

How is it calculated?

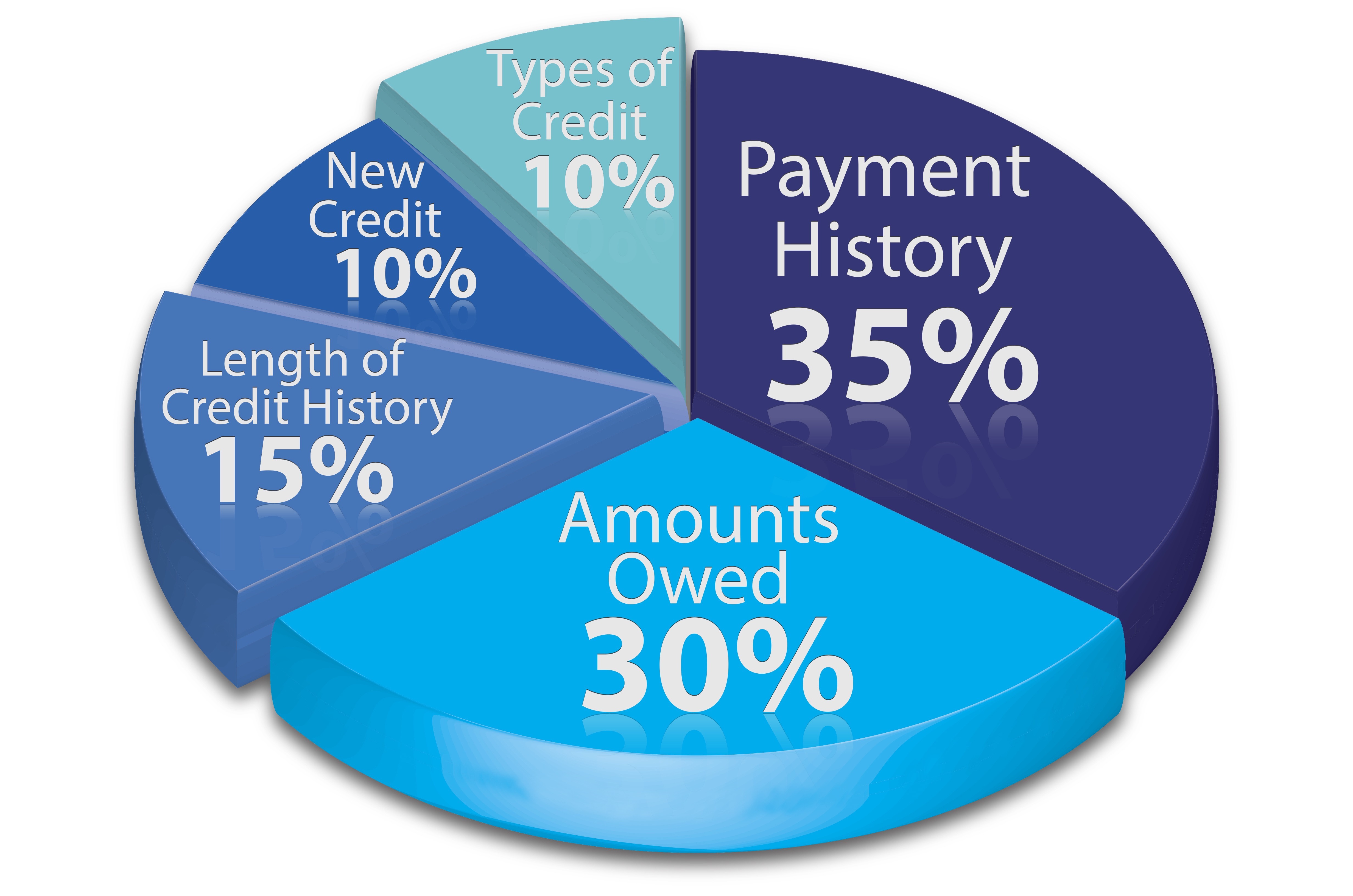

The most important factors in calculating your credit score are:

Credit utilization rate – meaning the percentage of the total credit available you use. So, if you have loans, store cards, and credit card limits of $10,000 and you have used $4,500, you have an overall credit usage of 45%.

Payment history – this simply tracks the number of payments you have made on time versus those that were made late. Furthermore, this is broken down into payments made 30 days late, 60 and 90-days late. The later the payments are made, the more negative impact it will have on your score.

Additionally, there are other factors, marked as Medium and Low impact, such as the numbers of accounts you have, the average length of time you have had them and the amount of loans and cards you have applied for – successfully, or unsuccessfully. For a full breakdown of all the main factors, read The Bargain Radar’s article here.

The Credit Bureaus:

There are 3 main consumer credit bureaus: Equifax, Experian, and TransUnion. These are the companies that collate, gather and store your financial information. These companies are the ones your potential lenders will contact and refer to when they receive an application for a new loan or credit card. These are the companies that you can contact directly, or via the Credit Repair companies, to challenge anything you think is incorrect on your report, update information and make sure your report reflects reality.

Who creates your ‘credit score’?

The two main companies generating your Credit Scores are FICO and VantageScore.

The Fair Isaac Corporation (FICO) emerged in 1989 and was totally dominant in the sector until 2006 when VantageScore launched.

Credit Score bands (FICO):

Exceptional: 800 to 850.

Very good: 740 to 799.

Good: 670 to 739.

Fair: 580 to 669

Very poor: 300 to 579.

Credit Score bands (VantageScore):

Excellent: 781 to 850

Good: 661 to 780

Fair: 601 to 660

Poor: 500 to 600

Very poor: 300 to 499

Will my score be the same on both?

The simple answer here is no. The two measurements use the same basic details but place a slightly different weighting/influence on the factors we mentioned above.

For both FICO and VantageScore, the ‘MOST influential’ factor is your payment history on all loans and credit cards. Late payments must be avoided at all costs.

The next most important for FICO is credit utilization. VantageScore also rank this as ‘HIGHLY influential’ but ranks the importance of the length of your credit history equally.

FICO put less influence on the length of your credit history, deeming it only ‘MODERATELY influential’.

The two also differ on the ‘LESS influential’ factors: VantageScore look at your recent credit behavior and applications for new cards or loans, whereas FICO investigate the mix of the types of credit you have. For example, if you have only credit cards and no loans you will be scored lower.

We advise you to look at your Credit Score in real detail. Understand all the elements that contribute to how you are perceived by financial institutions. It will give you a great insight into what your priorities should be and will get you into much better financial habits.